INTRO: Most people here in New Zealand think that the only viable asset investment which potentially yields the highest return on capital is real estate. In a sense, that’s probably true as the buying and selling of houses and plots of land as an industry is far more developed. That is largely because it’s central to the Kiwi dream of owning a home one day. But with ever rising prices of real estate, and particularly the anemic supply of housing stock as our population increases, the question of affordability has taken center stage. It is an issue that has been ‘politicized’ as a problem which needs fixing.

But is art another viable and equally lucrative investment option for Kiwis and can it be flipped like a house? There is much written and there is also much hype about the cost of fine art – one not necessarily confined to works of just “old masters”, which is gathering momentum. Demand for it has increased, and so have prices. The law of supply and demand configures it as an second attractive alternative.

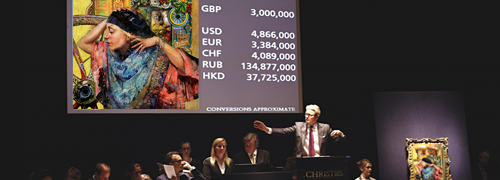

Take for example three oil on canvass portrait paintings by a New Zealand artist named Charles Frederick Goldie (1870–1947). These works of art fetched an astonish ing $900,000 or so at an auction held last 28 October 2014. More than 100 people packed the auction room that day and many more participated outside premises with their bids by calling in.

The successful agent for Goldie’s portraits at the auction at the International Art Centre in Parnell Auckland told a major news daily that he was “buying for a New Zealand client” and that there were many more such clients in New Zealand who collect art but would not give more details for privacy reasons.

By far the majority of Goldie’s subjects were elderly, tattooed Māori of considerable standing in their own society. Most of these were chiefs visiting the Native Land Court and others were visitors to Auckland to sit for him. His subjects were mainly those from tribes in the upper North Island. Many Māori now value his images of their ancestors highly.

Despite some critics considering his paintings “not art” on the rare occasions that they are offered for sale they fetch high prices, among the highest for New Zealand paint ings. In March 2008, NZ$454,000 (including buyer’s premium) was paid at an International Art Centre auction in Auckland for the painting “Hori Pokai – Sleep, ’tis a gentle thing”. That one small painting alone could have bought a comfortable 5-bedroom home inside a well-appointed city fringe suburb hand-over-fist!

But does art really hold its value in New Zealand? We think so. As mentioned earlier, one of the three Goldie paintings auctioned off earlier this week – “Thoughts of a Tohu nga, Wharekauri Tahuna”, sold for $416,000 – the highest price reached at a New Zea land art auction this year. What’s more, the International Art Centre – which specializes in resale and valuation of all 19th, 20th & 21st Century New Zealand fine art and consistently being at the forefront of the New Zealand art market since 1971, has an extensive national and global network of contacts within the industry. This it has done well in over forty years of trading.

Obviously, fine art that’s produced in New Zealand not only attracts local collectors and investors but global ones as well. With that level of engagement between buyers and sellers trading art as a capital investment makes it probably just as good as real estate.

The Editorial Board

Filipinos in New Zealand Group

______________________________________________________________

A DISCIPLINED APPROACH

In order to collect art intelligently, you have to master just two basic skills.

The first is being able to effectively research, evaluate and buy any single work of art that attracts you.

The second is being able to choose each individual work in such a way as to form a meaningful grouping, a practice more commonly known as collecting.

If you’re like most people, you might know how to buy art on a piece-by-piece basis, but may not be all that accomplished at formulating a plan for making multiple acquisitions over the long haul – in other words, building a collection.

You can find art that you like just about anywhere you look. There is an in credible variety of subject matters, mediums and price ranges, but that can be confusing as well as intimidating. So how do you wallow through it all and decide which direction to take?

How do you relate one purchase to the next? How do you organise or group your art together? How do you present it? And most importantly, how do you do all these things well?

This is what collecting is all about; it’s the ultimate case of controlled purposeful buying. It’s the same kind of discipline wise investors in real estate take.

FOR YOUR OWN ENJOYMENT

Great collectors are often as well known and widely respected as the art they collect. Each work of art in a great collection commands premium attention as well as eventually a premium price not only because it’s good, but also because of the company it keeps.

What will make you a great collector of art would be your ability to separate out specific works of art from the multitude of works that are already in existence and assemble them in such a way as to increase or advance your understanding of that art in particular. The whole becomes greater than its parts.

But irrespective of how you view your collecting, whether serious or recre ational, there are techniques that you can use to maximize not only the quality and value of your art collection, but also your own personal enjoyment, appre ciation and understanding of that art.

TAKING THE FIRST STEPS

Step one is being true to your tastes. This means acknowledging that you like certain types of art regardless of what you think you’re supposed to like or what seems to be the current rage. It’s never wise to acquire art on the basis of a fad or fashion.

All great collectors share this trait; that’s one thing makes their collections stand out. When personal preference is ignored in favor of the status quo, one collec tion begins to look just like the next. A few people dictate, the masses follow, everyone walks in lock-step, and the art you see from collection to collection becomes boring and repetitive.

Collectors who aren’t afraid to express themselves yield exactly the opposite results. They avoid the pitfalls of mimicking the tastes of others rather than be true to themselves. Fundamentally you need to listen to your inner voice and then know how one react to the piece of art you’re looking at. How do you see it! How does the artist use colour and depth of vision. What are his or her subjects? Is it authentic? Does the painting convey the message it represents in the title given to it by the artist?

Developing an ‘eye’ to see ‘art’ takes time and patience. But in the end one needs to feel it – that is, how it touches you, how it moves you and how you can you live with it and enjoy it hanging on the walls of your home or office.

TAKE A LOOK AROUND YOU

You may or may not be well along in your collecting, but if you have any nagging doubts about what you’ve been buying, what you’ve deliberately avoided, whether you’re totally satisfied or you just want to take a moment to see what’s new, suspend your buying decision for a while and take a look around you. Don’t confine yourself just to the same old museums or galleries or wherever you’ve been looking at art. Get out there and see what else is going on.

The Internet is a great tool to use and a quick way to search for what you’re look ing for. There are a number of unknown contemporary artists in New Zealand who produce fine art which rank among the best but they are not on display as yet in established galleries simply because they haven’t been ‘discovered’ yet or simply the costs of launching an inaugural exhibit is prohibitive in this country. Once in a while these artists exhibit a few works of art digitally on the Web and that’s where you can find them.

When you do find them, however ask yourself questions like:

* Why do you like the kind of art this artist has created?

* What is it about the art I see which satisfies me?

* Do I like the subject matter and what it represents?

* Does it transport me to a special place or make me feel a certain way?

* Am I struck with some of its compositional or technical aspects?

* Does it make me see life a bit differently?

If some of the answers to these questions are in the positive then not only does this improve your ability to separate great art from the good, but also from the not so good. You’re now beginning to learn how to protect yourself against being taken advantage of in the marketplace. This brings us to the next important point.

KEEP AN EYE ON THE MARKET

Hand in hand with understanding the art is knowing the marketplace. This is where many collectors fall short.

Top collectors go to great lengths to stay ahead of the curve. Their keen eye and sense of potential for acquiring works of a particular artist long before he or she becomes better known publicly allows them to invest at price levels that event ually deliver the greatest yields over time.

There are many artists from the 17th, 18th, 19th and even the 20th century who early in their careers produced exceptional works which nobody took notice of and these included even the so-called art connoisseurs of those times. But the wiser of them scooped up their works thereby denying the competition when those works of art in their collection became sought after by many and therefore valuable.

Since their collections included many pieces acquired from artists prior to being discovered and recognized by the world of art and, because these sought after artworks later on came up for sale the prices these art works command have become what people consider as astronomical. Why? It’s because the wise collector who scooped them up before anyone else did can afford to sit and wait comfortably in his or her armchair for the price of his collection (that everyone else now wants) to rise evermore higher and that’s simply because they don’t come up all that often anymore.

Great collectors know just about everyone who buys what they collect; they’re on top of the market and the market players and movers know them and what ‘treasures’ they have tucked away.

NOTHING RANDOM OR ARBITRARY

Just remember that regarding art pieces that do make it into your collection, most novice collectors will admit that they buy what they like. That’s definitely the best way to buy, but as you gain experience, the reasons why you buy what you like should become increasingly more conscious, complex, sophisticated and purposeful.

For example, you might hear an advanced collector say something like, “Not only do I love this painting, but it’s also a prime example of the artist’s best subject matter dating from his most productive time period and it fills a major gap in my collection.” Then another would say “this artist explored the nuances of a new medium of creating art and mastered it.” This sense of sureness and direction in their overall plans for building up a collection is what distinguishes a superior collection from an inferior one.

In a superior collection, every piece belongs; nothing is random or arbitrary. Once you identify the common traits, you can refine your buying to zeroing in on additional pieces that share those traits. A collector with a specific mission or goals is always more effective at acquiring art over the years than one who rarely questions why they buy what they do. If the answers to your questions sound like these – “I buy what my friends buy; I buy only the big names; I only buy bargains”, then consider returning to square one, determining what kinds of art you really really like, and then starting all over again.

There, the secret is out. Collect art because it means something to you and you like it. Chances are that over time hundreds even thousands of other will too and be willing to pay absolutely crazy prices for a piece of your collection. That’s how markets work.

Collecting art increases not only your enjoyment, but it also reinforces your chosen direction and your future buying which all together becomes a retire ment nest egg or something you can pass down to your children for their future financial security. Not only do you become a great collector and a savvy inves tor but also a good parent.

If you expect to have any influence over the long term future of your collection, lay the groundwork beginning right now. Educate your family about what you own. Instill a love and respect for what you’re aiming to accomplish and accu mulate for future years ahead. In that time span, make an effort to inform those close to you that they become aware of your art collection’s increasing value and significance. Make sure that they understand how important it is to you and eventually for them. You can’t control the ultimate outcome, but at least you can have your say and know that you’ve done your best to be a great collector.

RELATED ARTICLE:

Filipinos in Wellington | Art as Investment

______________________________________________________________

During the Spanish

During the Spanish